LIC TAX SAVING POLICY

In the labyrinth of financial planning, individuals often seek avenues that not only safeguard their future but also optimize their tax liabilities. In this pursuit, LIC Tax Saving Policy emerges as a beacon of financial prudence, offering a symbiotic blend of wealth accumulation and tax efficiency. As we navigate through the intricacies of tax-saving instruments, let’s unravel the manifold benefits of the LIC Tax Saving Policy and its alignment with income tax slabs, savings, and regulatory provisions under Sections 80C, 80D, and 10(10D).

Understanding LIC Tax Saving Policy:

LIC Tax Saving Policy stands as a stalwart in the realm of financial instruments, meticulously crafted to provide individuals with the dual benefits of life insurance coverage and tax savings. This policy not only serves as a shield against unforeseen contingencies but also facilitates long-term wealth accumulation through disciplined savings and prudent investment strategies.

Aligning with Income Tax Slabs:

One of the primary attractions of LIC Tax Saving Policy is its alignment with income tax slabs, allowing individuals to optimize their tax savings based on their income levels. Under the prevailing income tax structure, individuals fall into different tax brackets based on their annual income, ranging from nil taxation to higher tax rates for higher income groups. LIC Tax Saving Policy provides individuals with the flexibility to tailor their investments in accordance with their tax liabilities, thereby maximizing their tax savings potential.

Harnessing the Power of Section 80C:

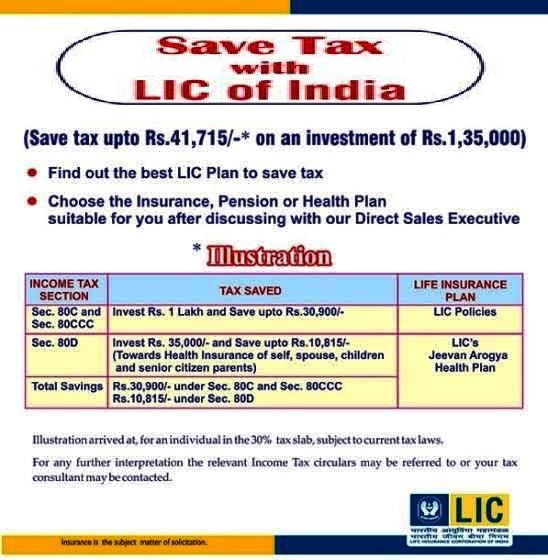

LIC Tax Saving Policy offers individuals the opportunity to avail tax benefits under Section 80C of the Income Tax Act. As per this provision, premiums paid towards life insurance policies, including LIC Tax Saving Policy, are eligible for deduction up to a maximum limit of Rs. 1.5 lakh per annum. By investing in LIC Tax Saving Policy, individuals can effectively reduce their taxable income, thereby lowering their overall tax liability and augmenting their savings.

Exploring Additional Tax Deductions:

In addition to Section 80C, the LIC Tax Savings Policy also offers tax benefits under other sections of the Income Tax Act, such as:

- Section 80D: This section allows individuals to claim deductions on premiums paid towards health insurance policies. The LIC Tax Savings Policy, with its bundled health insurance coverage, enables individuals to avail additional tax benefits, further enhancing their tax savings portfolio.

Tax-Free Maturity Benefits under Section 10(10D):

One of the standout features of the LIC Tax Savings Policy is the tax-free nature of the maturity benefits. Under Section 10(10D) of the Income Tax Act, the maturity proceeds received from the LIC Tax Savings Policy are entirely tax-free, ensuring that individuals can reap the rewards of their investments without any erosion due to taxes. This tax exemption not only fosters long-term wealth accumulation but also provides individuals with financial security and peace of mind.

Conclusion:

In a world characterized by financial uncertainties and tax complexities, the LIC Tax Savings Policy emerges as a beacon of stability and prudence. By offering a judicious blend of life insurance coverage, tax benefits, and tax-free maturity proceeds, this policy empowers individuals to secure their future while optimizing their tax liabilities. The LIC Tax Savings Policy stands as a testament to financial foresight, guiding individuals towards a future imbued with prosperity, security, and peace of mind.