LIC ALL IN ONE PLAN

All-in-One Solution for Financial Security and Prosperity

Call: 9480240513 to buy LIC All in one plan

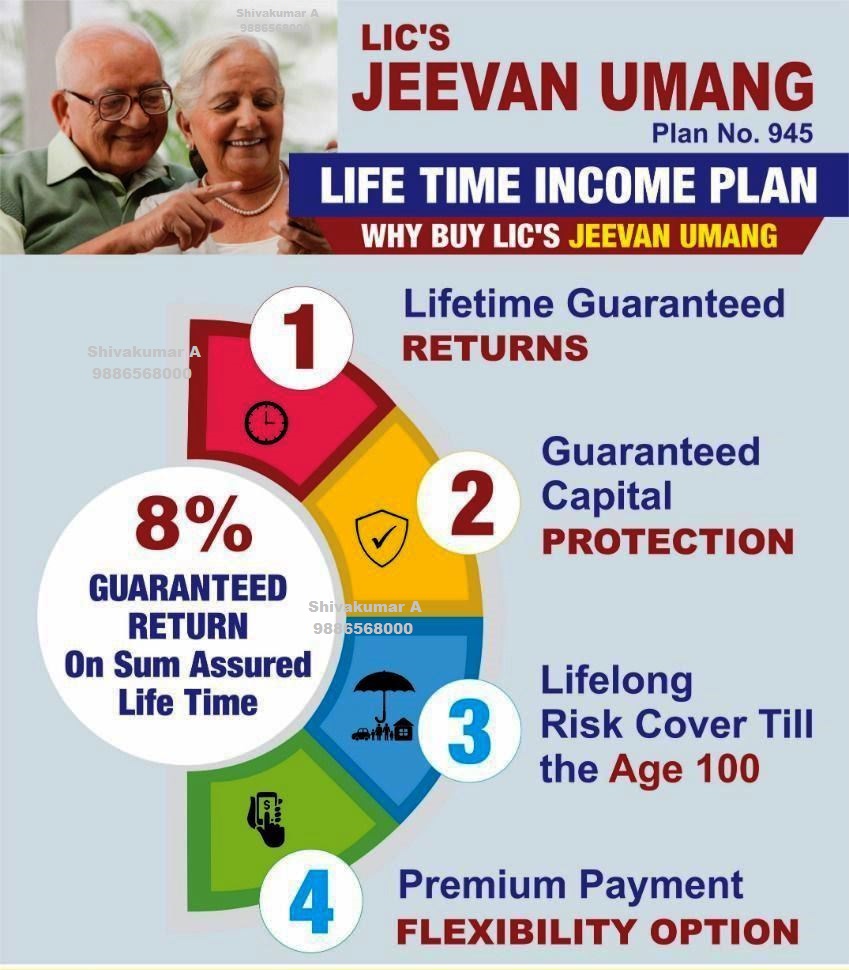

In the dynamic landscape of financial planning, individuals often seek comprehensive solutions that cater to their diverse needs, ranging from insurance coverage and investment growth to tax efficiency and retirement planning. In response to this demand, LIC (Life Insurance Corporation of India) presents Jeevan Umang, an all-in-one plan meticulously crafted to provide individuals with a holistic approach to financial security and prosperity. Let’s embark on a journey to explore the myriad benefits of LIC Jeevan Umang, which seamlessly integrates insurance, investment, tax-saving, pension, and whole life coverage into a single, comprehensive package.

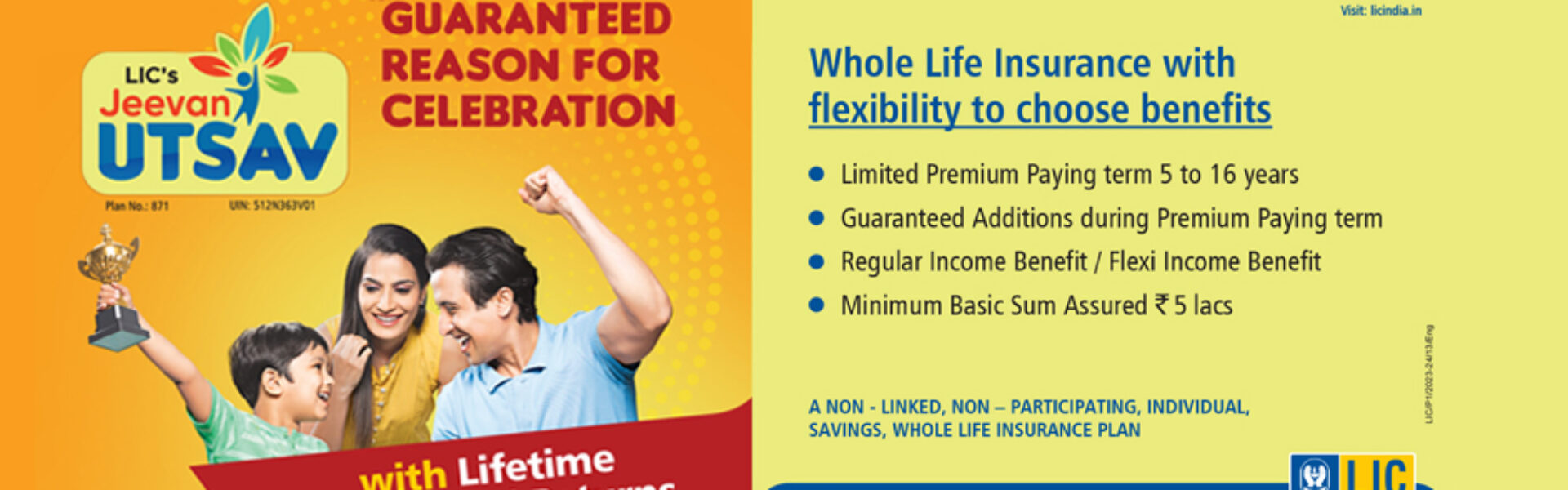

Understanding: LIC ALL IN ONE PLAN: LIC Jeevan Umang:

LIC Jeevan Umang stands as a testament to innovation and foresight, offering individuals a unique blend of life insurance coverage, investment growth, tax benefits, pension provision, and whole life assurance. This versatile plan caters to the multifaceted needs of individuals, providing them with a single platform to address their financial goals and aspirations.

Comprehensive Insurance Coverage:

At the heart of LIC Jeevan Umang lies comprehensive insurance coverage, ensuring that individuals can safeguard their loved ones’ future against unforeseen contingencies. With a wide range of coverage options and flexible premium payment terms, this plan offers individuals the peace of mind that comes with knowing their family’s financial well-being is secure, irrespective of life’s uncertainties.

Investment Growth and Tax Savings:

In addition to insurance coverage, LIC Jeevan Umang facilitates long-term wealth accumulation through its investment component. By allocating a portion of the premium towards investment funds, individuals have the opportunity to capitalize on market growth and generate attractive returns over time. Moreover, premiums paid towards LIC Jeevan Umang are eligible for tax deductions under Section 80C of the Income Tax Act, providing individuals with a dual benefit of tax savings and wealth accumulation.

Pension Provision and Retirement Planning:

LIC Jeevan Umang goes a step further by addressing individuals’ retirement planning needs through its pension provision feature. By opting for a policy term ranging from 15 to 35 years, individuals can tailor their premium payments to coincide with their retirement age, ensuring a steady stream of income during their golden years. This pension provision not only offers financial security but also empowers individuals to retire with dignity and independence.

Whole Life Assurance and Tax-Free Returns:

One of the most compelling features of LIC Jeevan Umang is its whole life assurance, which provides individuals with coverage up to the age of 100 or beyond. This ensures that individuals can enjoy lifelong protection and financial security, knowing that their loved ones will be taken care of no matter what life may bring. Furthermore, the returns generated from LIC Jeevan Umang are tax-free under Section 10(10D) of the Income Tax Act, allowing individuals to reap the rewards of their investments without any erosion due to taxes.

Conclusion:

In a world characterized by complexity and uncertainty, LIC Jeevan Umang emerges as a beacon of simplicity and security, offering individuals a comprehensive solution for their financial needs. By seamlessly integrating insurance, investment, tax-saving, pension provision, and whole life assurance into a single, cohesive plan, LIC Jeevan Umang empowers individuals to build a brighter, more secure future for themselves and their loved ones. As we navigate through life’s journey, LIC Jeevan Umang stands as a trusted companion, guiding us towards financial prosperity and peace of mind, both now and in the years to come.

Why LIC ALL IN ONE PLAN – LIC JEEVAN UMANG, is recommended is that this plan has life insurance, Investments, Tax savings, pension and whole life benefits

An experienced Advisor can help you to start a plan as per your lifestyle, needs.