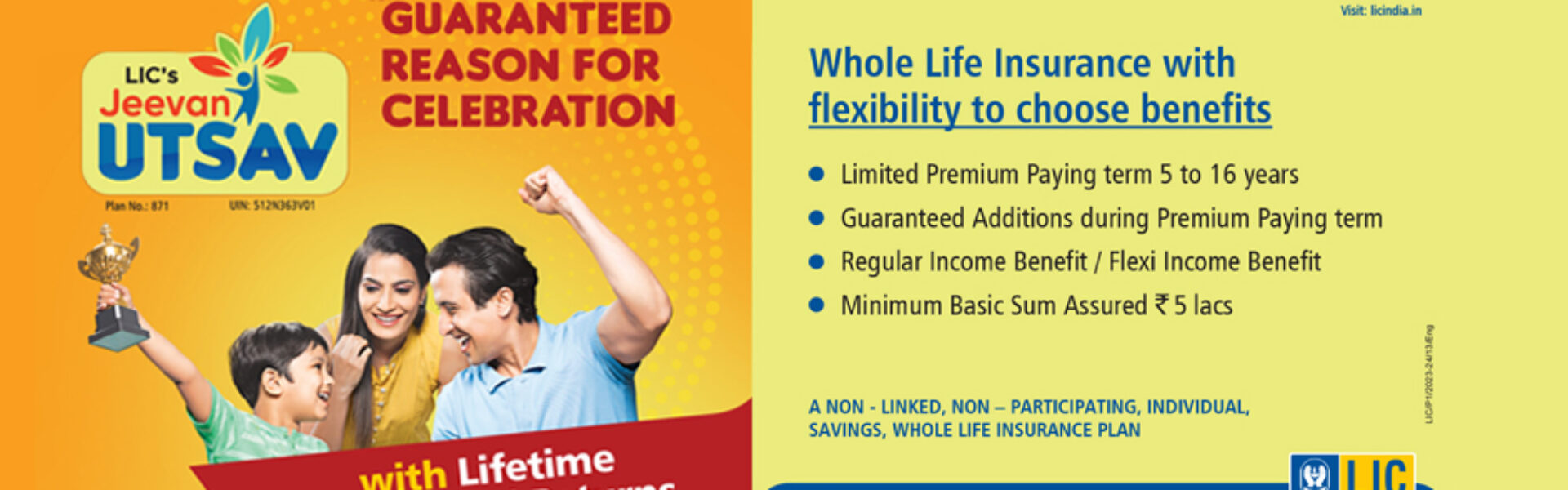

LIC monthly income plans

Amidst escalating tensions in Iran and Ukraine, global geopolitics are under scrutiny, posing significant challenges to international relations. The whole world is tense due to the two wars between four powerful countries. The specter of war casts a shadow over diplomatic efforts, raising concerns about stability and security. There are many other issues in the world today, like floods and droughts. This is an alarming situation for those who depend on their salary alone. Plan for a fixed income investment that would give monthly returns every month on the first or second day.

Call 9480240513 for more information

In such turbulent times, uncertainty looms large, impacting economies and livelihoods. For individuals facing the prospect of a future without regular income, the need for financial preparedness becomes paramount. Planning for contingencies, diversifying income streams, and investing in safety nets like insurance and savings are crucial steps towards navigating an uncertain future with resilience and stability.