LIC Pension Plans

Start a Pension plan today, Call: 9480240513

In India, LIC pension plans are available by paying regular premiums and also by paying a one time premium. Planning for a stable financial future post-retirement is crucial, and Life Insurance Corporation of India (LIC) offers various pension plans designed to meet this need. LIC’s pension products, like Jeevan Umang, Jeevan Shanti, Jeevan Dhara II, and Jeevan Akshay, provide different avenues for guaranteed lifetime income, catering to various retirement planning needs. This article will delve into these plans, highlighting how they can secure your financial future and ensure peace of mind during retirement.

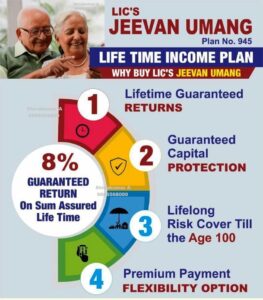

LIC Jeevan Umang

LIC Jeevan Umang is a whole-life, non-linked, participating insurance plan that offers both protection and savings, extending up to the age of 100 years. It provides a combination of income and security to your family.

Features:

-

- Policy Term: Coverage until age 100.

- Premium Payment Term: Options of 15, 20, 25, or 30 years.

- Survival Benefits: Post the premium payment term, 8% of the sum assured is paid annually as a survival benefit until maturity or the policyholder’s prior death.

- Maturity Benefits: Sum Assured on Maturity along with bonuses, if any.

Benefits:

-

- Guaranteed Income: Provides a steady income after the premium payment period, ideal for retirement.

- Flexibility: Multiple premium payment terms allow for financial planning according to one’s career span and earning capacity.

- Comprehensive Coverage: Extends protection up to 100 years of age, thereby covering the risk for an extended period.

LIC Jeevan Shanti

LIC Jeevan Shanti is a non-linked, non-participating, single premium annuity plan that offers a range of annuity options with various modes of annuity payments. It provides options for either an immediate annuity or a deferred annuity, based on the policyholder’s needs.

Features:

-

- Annuity Options: Multiple options are available, catering to different retirement needs, including options for life, with a provision for spouse, and growth in annuity.

- Deferred Annuity: Allows for accumulation of the corpus and initiation of the annuity payments at a later date, preferred by those who are still in their earning phase.

- Single Premium: Payable at the beginning, which purchases the annuity equivalent to the amount invested.

Benefits:

-

- Guaranteed Lifetime Income: Both immediate and deferred annuity plans ensure a fixed income throughout the retiree’s lifetime.

- Flexible Options: A wide range of annuity options helps tailor the retirement income according to personal and family needs.

- Incentives for Higher Investment: Higher the investment, better the annuity rates offered, maximizing the retirement benefits.

LIC Jeevan Akshay

LIC Jeevan Akshay is an immediate annuity plan that can be purchased by paying a lump sum amount. The plan offers various annuity options and is designed to provide for the policyholder’s financial needs immediately after retirement.

Features:

- Immediate Annuity: Annuity payments start as soon as the premium is paid in a lump sum.

- Multiple Annuity Options: Offers several options for annuity payment, including for life, increasing at a fixed rate, for a guaranteed period, etc.

- No Upper Limit for Purchase Price: Allows a larger investment for higher annuity.

Benefits:

- Ease of Use: Simple product structure and easy to understand, with immediate benefits.

- Lifetime Income: Provides a steady income stream right from the point of retirement.

- Tax Benefits: Annuity payments are subject to tax as per the income tax slab of the annuitant, but the plan offers tax benefits at the entry stage.

Comparative Analysis and Suitability:

- For Young Investors: Jeevan Umang is more suitable as it provides long-term protection and savings, growing the investment over a longer period before yielding periodic returns suitable for post-retirement life.

- For Immediate Retirement Planning: Jeevan Akshay and Jeevan Shanti are more apt for individuals who are at the brink of retirement or have already retired, offering immediate or deferred annuity options to start their retirement income based on current savings.

LIC’s range of pension plans offers robust solutions for different stages of life and financial needs, ensuring that retirement years are spent with financial stability and peace of mind. Whether you are planning early for retirement with Jeevan Umang, looking for immediate pension benefits with Jeevan Akshay, or preferring a more flexible approach with Jeevan Shanti, LIC provides a comprehensive portfolio to choose from. These plans not only secure an income during your non-working years but also ensure that your lifestyle remains unaffected by the transition into retirement. Investing in a suitable LIC pension plan can help safeguard your future, providing guaranteed lifetime returns and the joy of a secure retirement.